Caruso Weekend Report: March 02, 2025

This report is a small part of the Caruso Insights membership and serves as an excerpt from the full weekend report. It is provided to members as a quick takeaway document for the upcoming week.

This past week saw markets buckle under the pressure of tariff threats and proposed US government spending cuts, which accelerated after NVDA’s big earnings “beat” was met with significant selling. When good news results in downside action, it typically implies a stock has reached at least short- to intermediate-term “full value” and will require time or new surprises to move significantly higher again. When this occurs with a market leader and key pillar of the bull market, it will likely have a big impact on the market and how institutions rotate money.

This dynamic was on full display this week as NVDA’s post-earnings breakdown dragged down all major indexes. The impact was so large that, for the first time in weeks, large caps led the downside selling rather than small or mid-cap stocks. Had it not been for some very late Friday buying, markets would have closed near the lows of the week.

This dynamic was on full display this week as NVDA’s post-earnings breakdown dragged down all major indexes. The impact was so large that, for the first time in weeks, large caps led the downside selling rather than small or mid-cap stocks. Had it not been for some very late Friday buying, markets would have closed near the lows of the week.

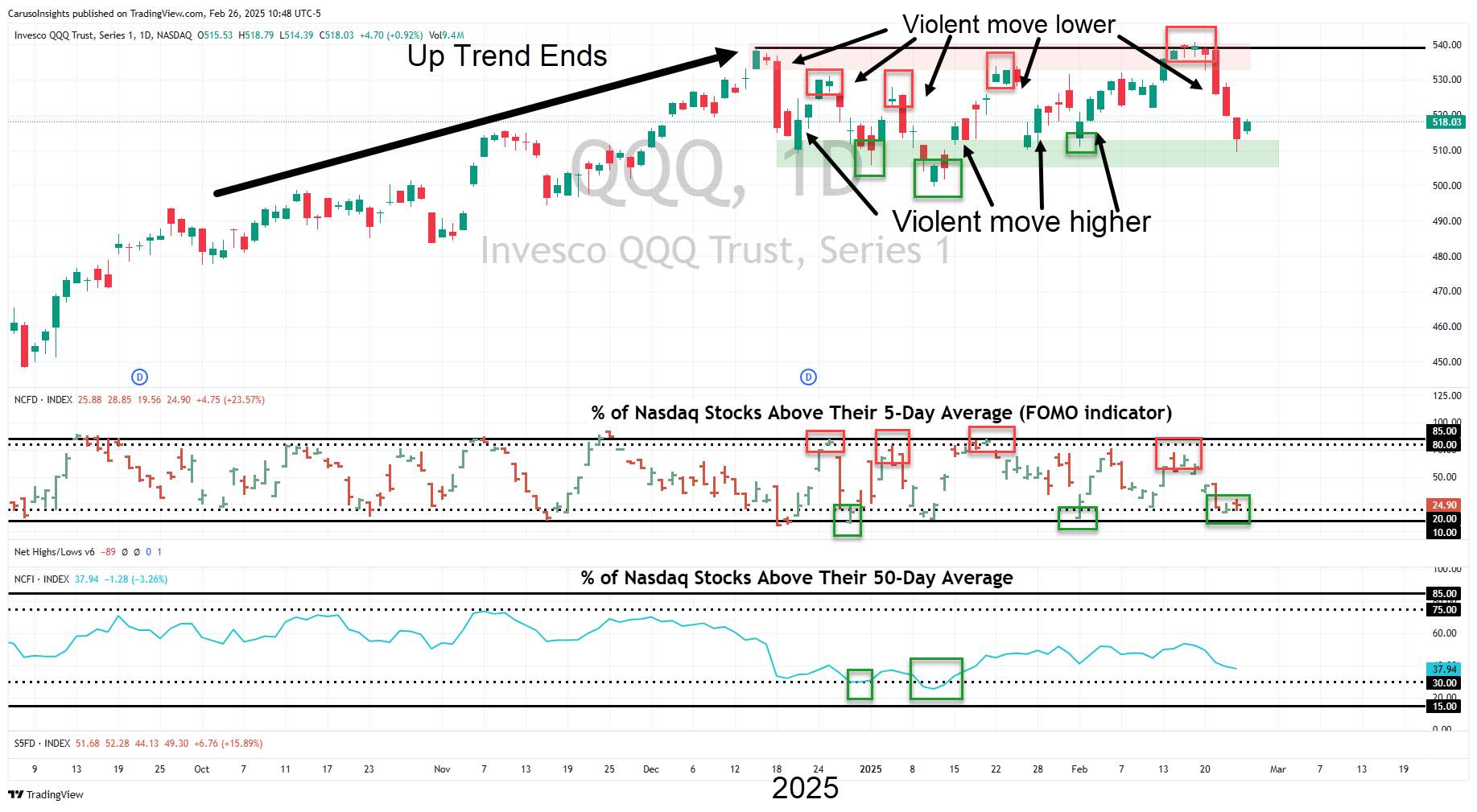

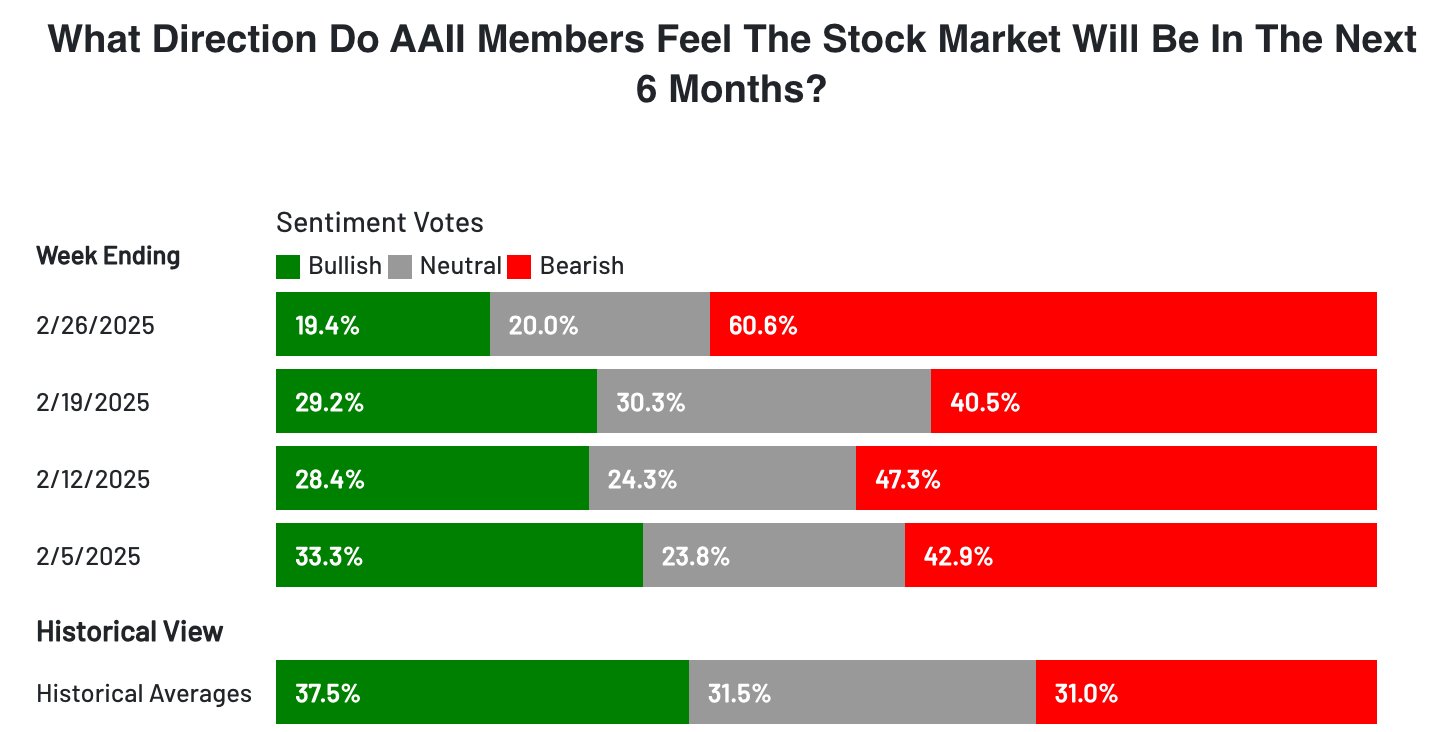

Market indicators have also weakened and saw a continued increase in net lows. However, whether this leads to a continued downside depends on whether we have truly entered a bear market or are simply in a normal sideways consolidation. As discussed in my recent YouTube video on sideways markets, rallies happen when things look worst, as trading is dominated by positioning. That means if most people turn bearish, the worst is over, and no one is left to sell. But how do you measure bearishness? And how do you know if we are in a new bear market or simply a choppy market?

In my research, it’s typically smart to buy when sentiment surveys, such as the AAII and breadth indicators, signal widespread pessimism—as they do now.

In my research, it’s typically smart to buy when sentiment surveys, such as the AAII and breadth indicators, signal widespread pessimism—as they do now.

However, caution is key when negative monetary drivers emerge, even if sentiment is bearish. A good example is 2008 when bearish AAII sentiment did little to prop up markets because there was a more significant downside monetary driver.

However, caution is key when negative monetary drivers emerge, even if sentiment is bearish. A good example is 2008 when bearish AAII sentiment did little to prop up markets because there was a more significant downside monetary driver.

Consider these examples:

Consider these examples:

-

The 2000 bubble burst, triggered by Fed rate hikes (monetary driven).

-

In 2008, a credit collapse followed bad loans drying up liquidity (monetary driven).

-

The 2011 European debt crisis hammered markets (monetary driven).

-

In 2018, a hawkish Fed fueled a bear market, relenting only after a 20% drop (monetary driven).

-

In 2020, COVID paralyzed the system until massive monetary intervention stepped in.

-

In 2022, Fed hikes to tame inflation again pressured markets (monetary driven).

So, the current situation has the Fed “on hold,” but the impact on money and credit is being driven by the US government. DOGE, planned Administration spending cuts, and tariffs are beginning to be factored into the market. Even if the cuts are needed and target wasteful spending, the market will not differentiate in the short term as it impacts liquidity.

So, is this a reason to be tremendously negative? Not in my view. Many of the cuts, tariffs, and more are not final decisions. President Trump likes to negotiate and is pro-business, so the ultimate impact is still to be determined. However, it is a reason to be concerned, cautious, and to approach the market carefully. As discussed in this week’s video, a market such as this requires:

-

An understanding of what is really driving markets,

-

What positioning is for most investors,

-

The humility to slow down until point 1 has signs of a resolution (not the actual resolution—by then, markets will have already taken off).

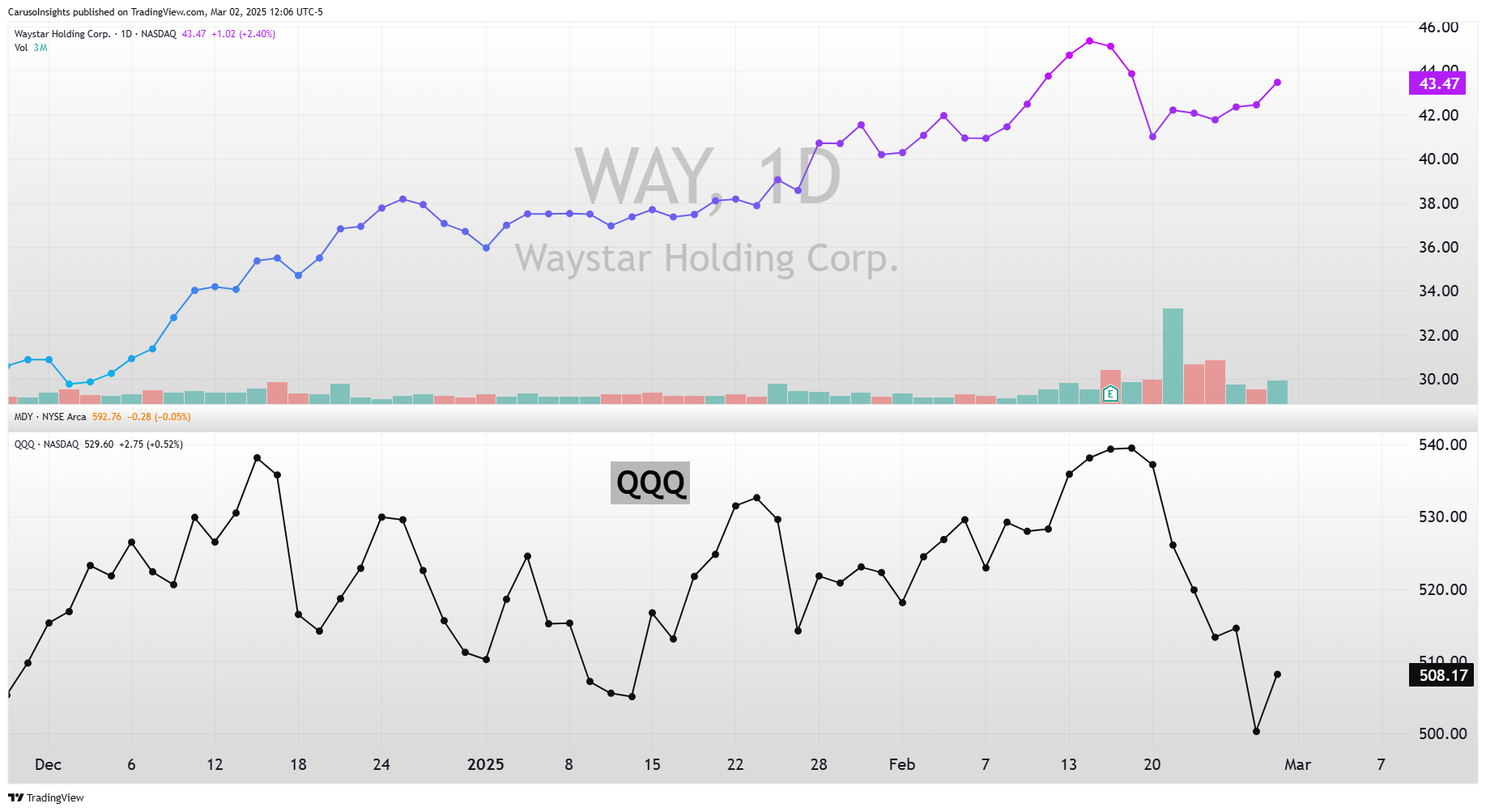

For the time being, my focus is on identifying which stocks are bucking the market weakness, indicating consistent institutional demand regardless of a weak market. Stocks such as CWAN, WAY, and many others are making their way to the top of my watchlist.

Know More About Our Membership