Caruso Weekend Report: March 09, 2025

This report is a small part of the Caruso Insights membership and serves as an excerpt from the full weekend report. It is provided to members as a quick takeaway document for the upcoming week.

Weekend Summary

Markets endured another week of heavy selling, with all major indexes dropping 3 to 4%. Beneath the surface, the damage was far worse, especially for growth stocks. Names like TSLA, RDDT, NVDA, SPOT, SHOP, HOOD, VST, and others plummeted 10 to 20%. Defensive stocks softened the blow for indexes, but that offered little comfort to investors in more dynamic companies.

One notable trend emerged: most stocks hit their lows on Tuesday, even though new lows appeared on Friday. This is evident when tracking the number of stocks making 52-week lows each day. While this suggests fewer stocks are driving the decline—hinting at rotation—it’s too early to call a significant bottom.

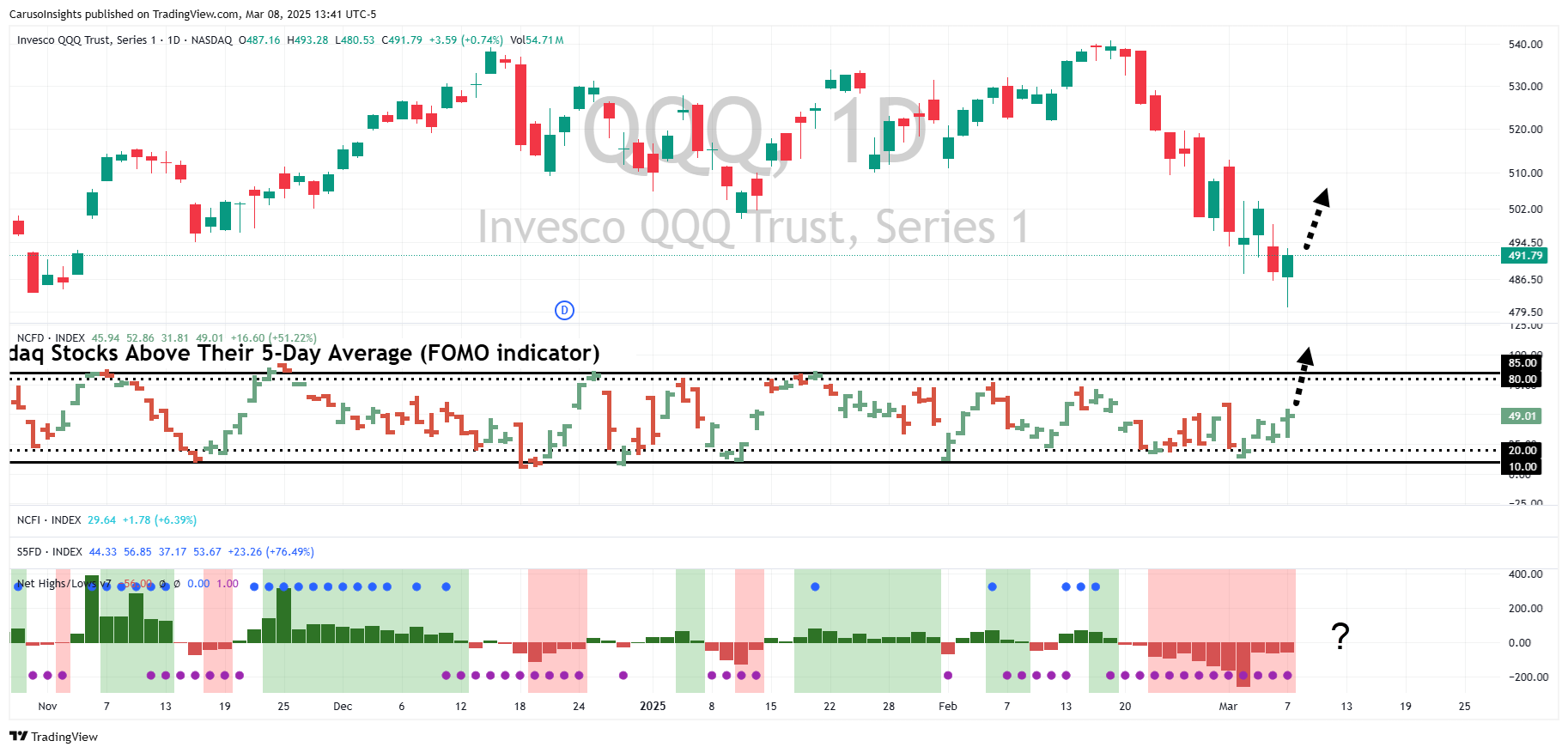

The FOMO indicator in the chart below shows the percentage of Nasdaq stocks above their 5-day average—a sharp measure of short-term sentiment and positioning. It confirms the new lows data, pinpointing Tuesday as the peak of the selling pressure. However, if stocks rally and FOMO spikes while we remain in a broader downtrend (marked by persistent net lows—more 52-week lows than highs), such short-term buying often triggers more selling. For context, I’ve included corrections from 2023 back to 2020, highlighting this pattern: quick FOMO-driven rebounds typically fade when net lows linger.

Current Chart:

Fall 2023:

Fall 2022:

Spring 2022:

March 2020:

As noted last week, the key question is whether this is a standard 5-10% correction or something deeper. Historically, significant corrections tie to disruptions in money and credit. On Friday, Treasury Secretary Bessent told CNBC the economy faces a “detox” as the new administration shifts toward a private-sector focus, requiring “an adjustment.” That’s political code for pain. If successful, this pivot could greatly benefit the economy and broader population. The private sector is far more dynamic, efficient, creative, and productive than government. But as investors, we need to gauge if this goal will succeed and how much “adjustment” the economy must endure first.

This shift starts with government pulling back before the private sector steps up, cutting total spending. Add tariff uncertainty, and you have a recipe for disrupting monetary trends. Any shock to money and credit can spiral—your spending is my income, and declining spending and lending feed a domino effect. This explains why markets react so sharply to monetary shifts.

Fed Chairman Powell spoke this week, signaling patience and no rush to offset Trump-driven government cuts. The result? A short-term shock, hitting fastest-growing, most sensitive stocks hardest—growth names.

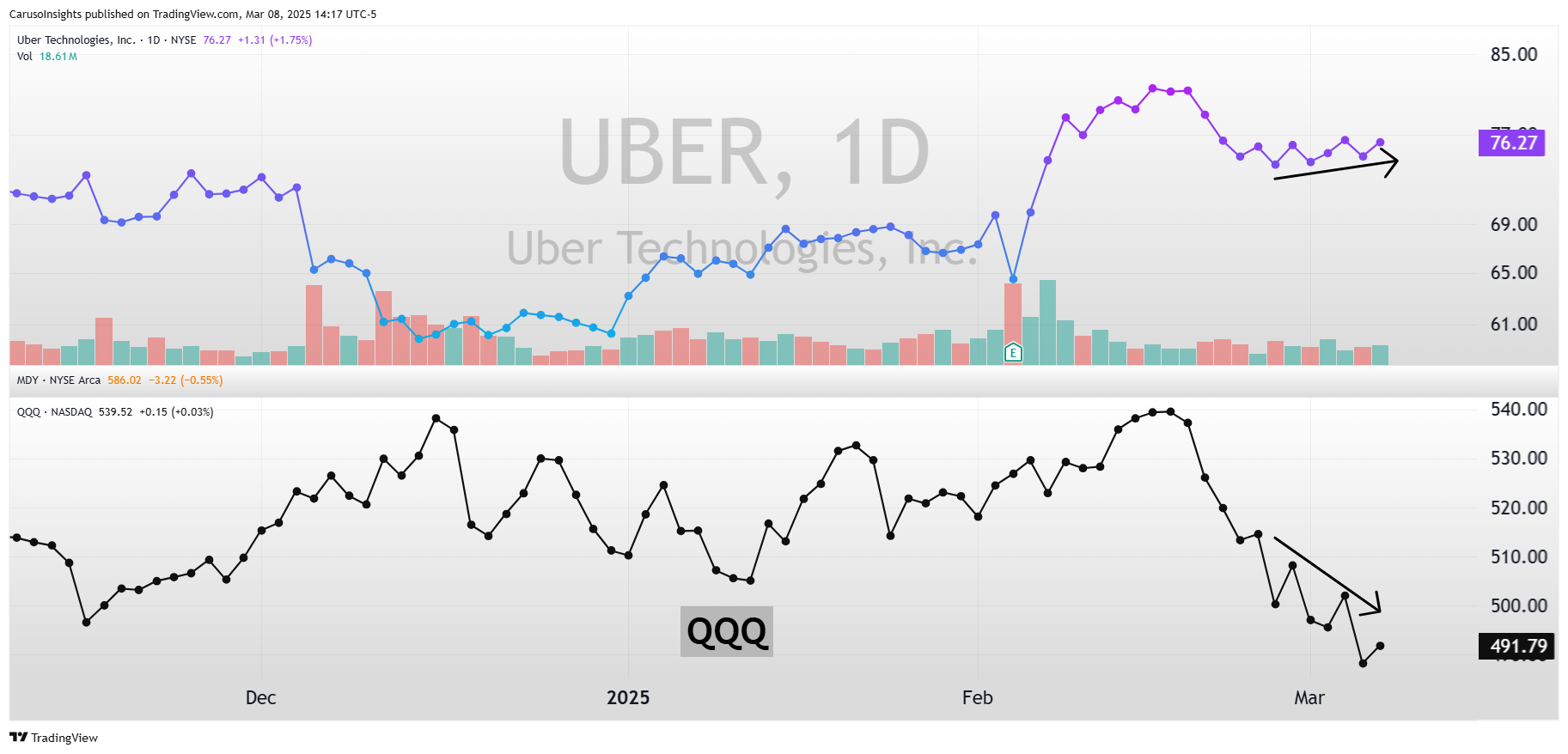

Indeed, growth stocks have cratered far more than indexes, driving sentiment polls to near-apocalyptic levels despite modest index declines. Most stock charts now show heavy distribution, with few displaying healthy action. Standouts like UBER exist, but they’re few at this time.

Still, this adjustment aims for a worthy goal: greater privatization. Once the correction runs its course, I see a tremendous opportunity. A more dynamic economy, likely lower interest rates, and the early stages of a tech revolution set the stage. Now is the time to stay focused on daily action—stocks under accumulation often reveal themselves in these markets. Some critical market signals we should look out for include a climax bottom, a higher low, net highs, or a Follow Through Day. Markets always bottom with one of these four patterns.

Never forget the value of balancing risk management with optimism, as this quote reminds us:

“Don’t be thrown off by the swarm of gloom and doomers. In the long run, they have seldom made anyone any money or provided any real happiness. I have also never met a successful pessimist.” – William J. O’Neil

Explore Our Membership