Caruso Weekend Report: March 16, 2025

This report is a small part of the Caruso Insights membership and serves as an excerpt from the full weekend report. It is provided to members as a quick takeaway document for the upcoming week.

Weekend Summary

Markets suffered a fourth straight week of selling, marking a fairly rare amount of consistency of selling. This drop has seen the S&P 500 and Nasdaq 100 erase all gains since last summer, however, small and mid-cap stocks have given back all of their 2024 gains and returned to 2021 price levels. This drop has been swift and meaningful with all major indexes in correction territory (-10%+) and small caps at just about bear market territory (-19.6%).

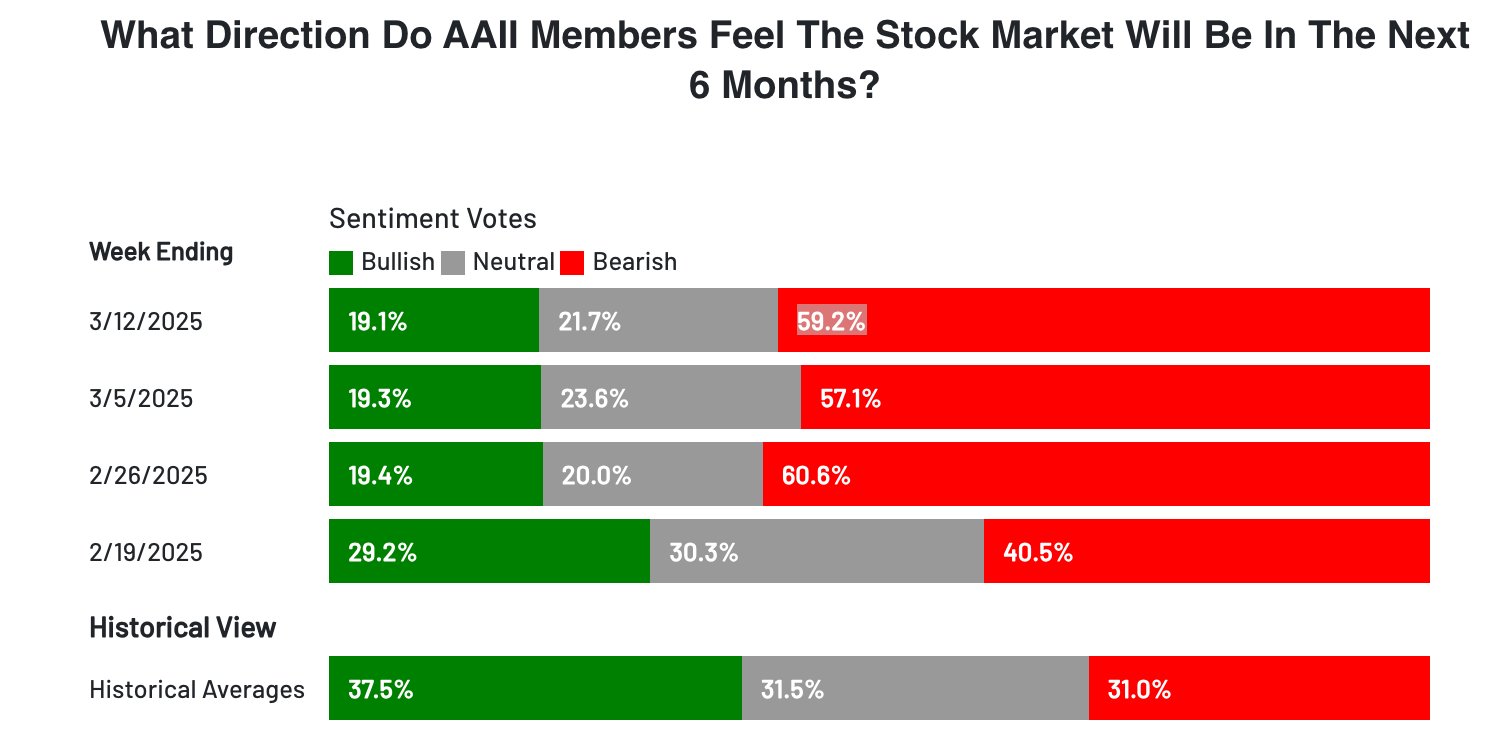

Tariff uncertainty, spending cuts and general uncertainty have driven this weakness. As dicey as the economy seems, the good news is the market has now priced in a substantial amount of uncertainty as investor sentiment surveys have fallen from frothy levels to those typically associated with major market lows.

Another major positive for hopeful optimists is that this market closely resembles 2018. Late that year, markets entered a swift bear market due solely to anticipated actions by the Federal Reserve to consistently raise interest rates in the coming months. The economy was not in distress, and there weren’t any significant issues except for the policies of a small group of individuals capable of derailing the market.

Historical Context

We find ourselves in a very similar situation today. There are no major economic problems, inflation is falling back to its target, and we're at the beginning of a tech revolution. However, much like in 2018—but this time driven by the US government—President Trump and his team are causing market turmoil as they seek to alter the status quo to reimagine the structure of the US economy.

Despite everyone’s concerns, policy can change on a dime. Just as Fed Chairman Powell pivoted in January 2019 when he recognized the impact of his policy, similarly, President Trump can “make a deal,” soften his terms, and revert to his typical pro-stock market stance if he believes he has secured a satisfactory deal or that his tough stance is causing more pain than potential gain.

Each day the market falls brings us closer to a resolution. Since the driving issue is one of policy and negotiation rather than economic decline, we can reach a resolution remarkably quickly. Therefore, we should focus on identifying what catalysts can drive positive change and which stocks are most poised to lead a turnaround.

Technical Bright Spots

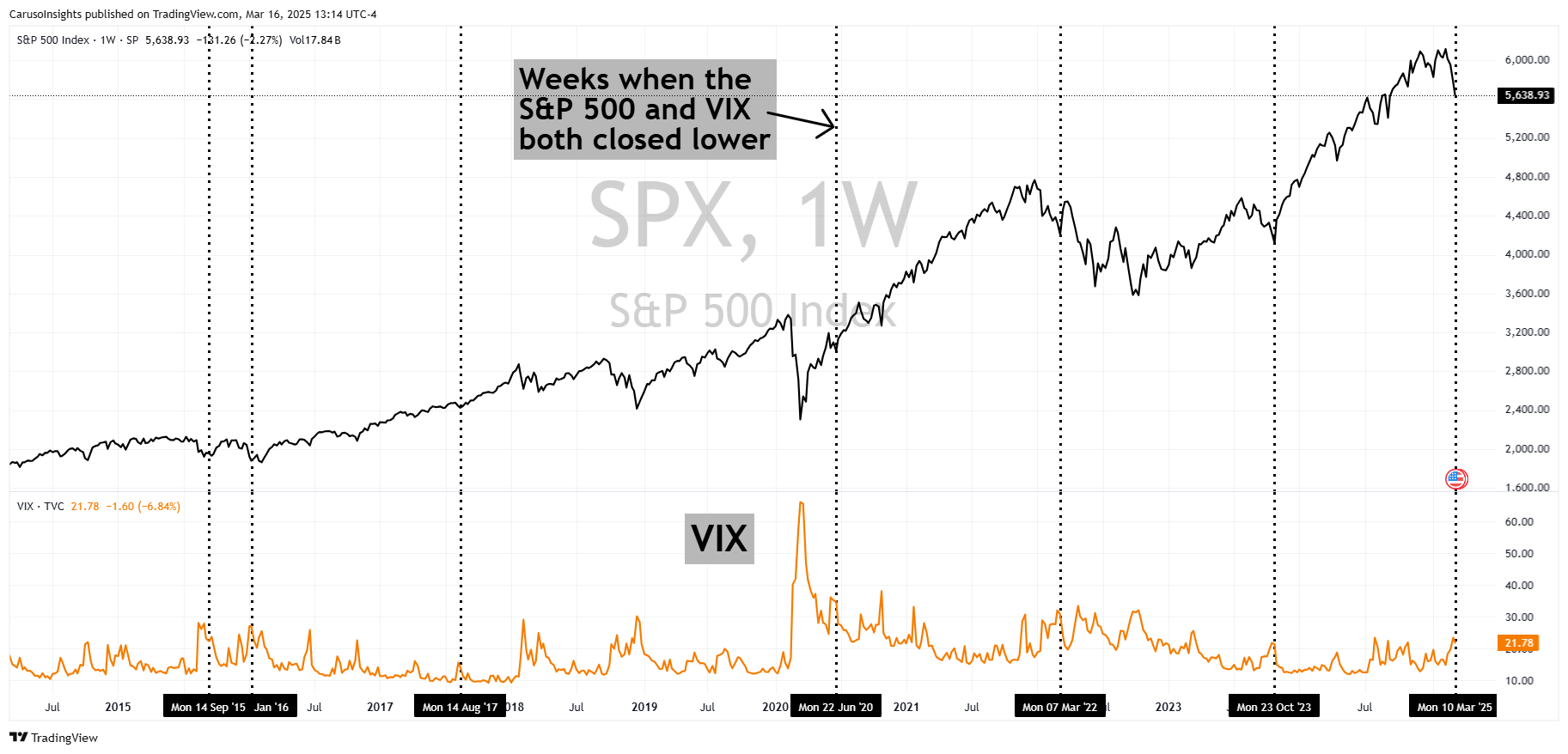

A notable technical bright spot this week was a decline in volatility, even as the market hit new lows. Normally, volatility rises during weeks of falling prices, making this pattern stand out. Historically, when the S&P 500 closes lower and the VIX drops too, it’s often a sign of a market bottom.

The primary challenge right now is timing amid heightened volatility. While this correction could resolve quickly, it’s vulnerable to a relentless stream of headlines. Reciprocal tariffs are slated to begin April 2nd, promising a barrage of updates from the US and its trading partners. To navigate this, keep an open, non-political perspective—markets will begin an uptrend at the hint that a solution will be found while rhetoric and uncertainty will still remain. Closely tracking shifts in political tone alongside market action will be the sharpest tool for staying ahead.

The primary challenge right now is timing amid heightened volatility. While this correction could resolve quickly, it’s vulnerable to a relentless stream of headlines. Reciprocal tariffs are slated to begin April 2nd, promising a barrage of updates from the US and its trading partners. To navigate this, keep an open, non-political perspective—markets will begin an uptrend at the hint that a solution will be found while rhetoric and uncertainty will still remain. Closely tracking shifts in political tone alongside market action will be the sharpest tool for staying ahead.

This environment underscores why a simple, objective framework—determining optimal market exposure, cash levels, and direction—is essential for long-term success. A disciplined process cuts through the noise.

Positive Stock Action

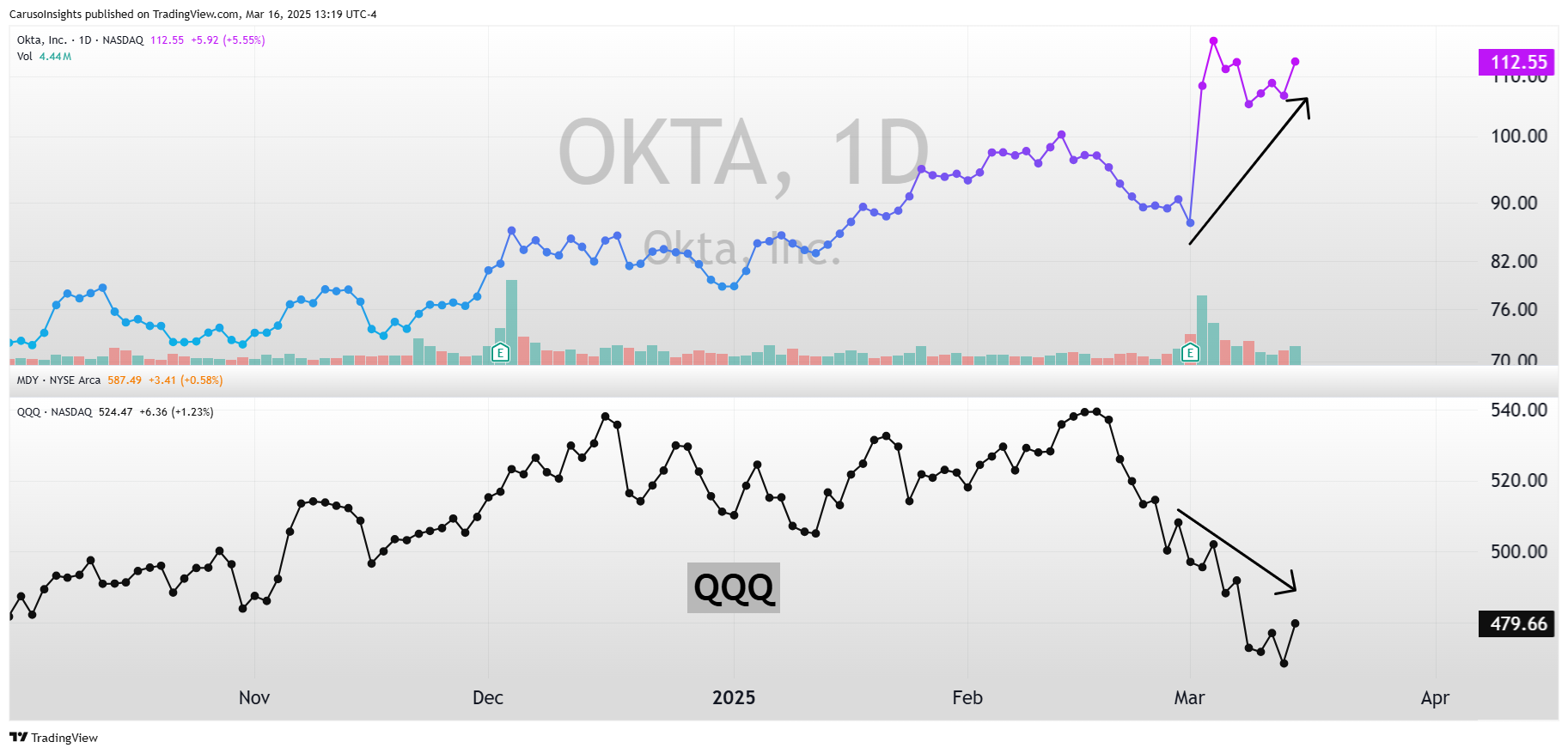

Amid the correction, the silver lining is how standout stocks and emerging themes rise to the top. One bright spot is cybersecurity, with stocks like OKTA and RBRK showing strong, resilient action.

Never forget the value of balancing risk management with optimism, as this quote reminds us:

“Don’t be thrown off by the swarm of gloom and doomers. In the long run, they have seldom made anyone any money or provided any real happiness. I have also never met a successful pessimist.” – William J. O’Neil