Caruso Weekend Report: March 23, 2025

This report is a small part of the Caruso Insights membership and serves as an excerpt from the full weekend report. It is provided to members as a quick takeaway document for the upcoming week.

Weekend Summary

Markets finally stabilized after suffering four consecutive weekly declines. This week’s main event was FED’s FOMC meeting which, not a dramatic change, I viewed as a positive development.

The FED mentioned how the market’s worries over a rise in inflation expectations was driven by political sentiment. This true ad Republicans see little to no future inflation while Democrats see a surge. It was a positive for the FED to look past what is an obvious political bias of the survey rather than react hawkishly.

Secondly, the FED’s lower growth and higher inflation estimates were based on tariffs and reciprocal tariffs being full implemented. My view is a negotiated settlement will appear, resulting in the FED’s forecasts to eventually be improved as the worst-case scenario is being priced in.

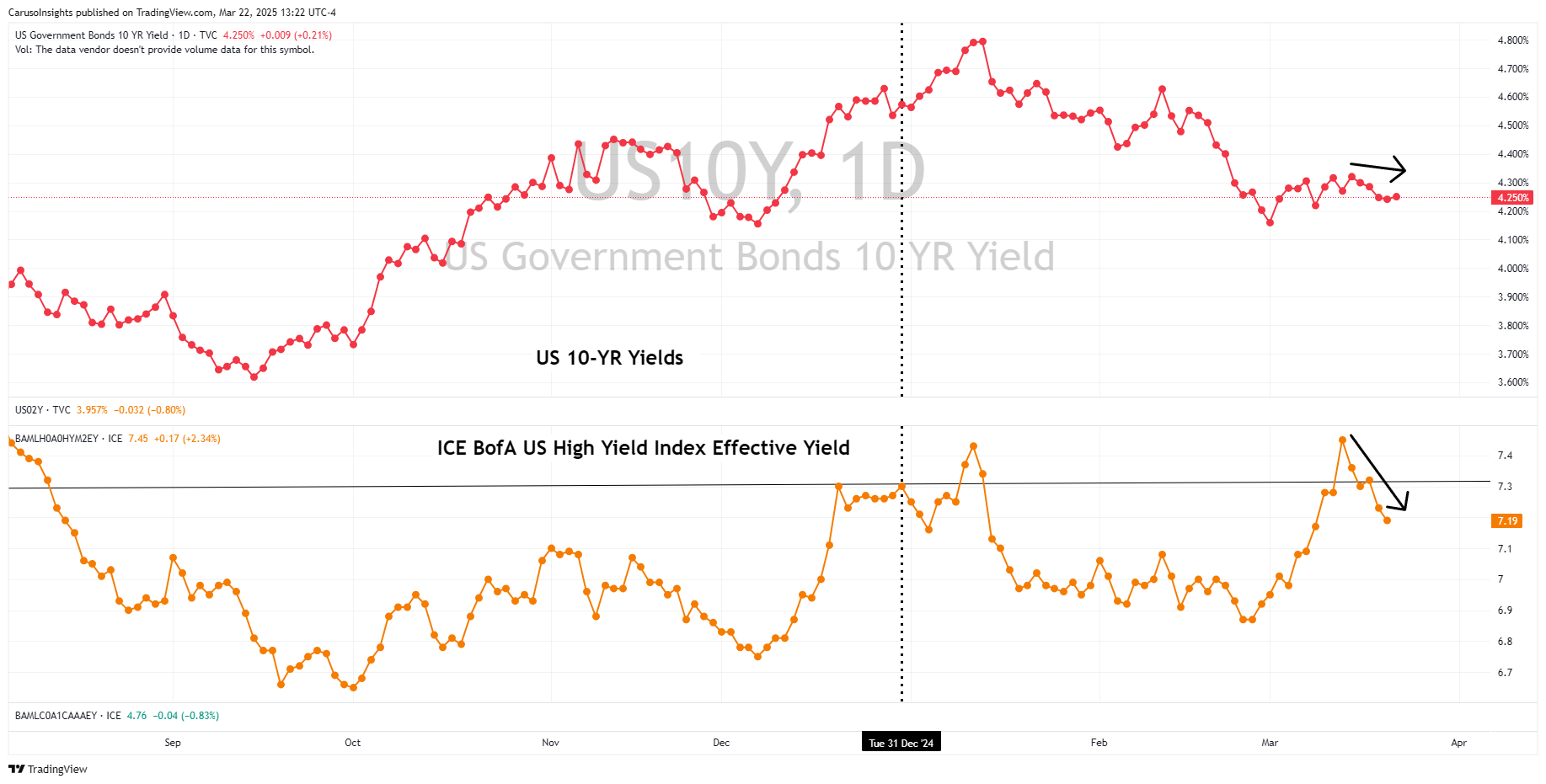

As a result, interest rates on High Yield corporate bonds fell much quicker than government bonds, indicating a renewed confidence by investors and an increased appetite for riskier assets.

Another major positive for hopeful optimists is that this market closely resembles 2018. Late that year, markets entered a swift bear market due solely to anticipated actions by the Federal Reserve to consistently raise interest rates in the coming months. The economy was not in distress, and there weren’t any significant issues except for the policies of a small group of individuals capable of derailing the market.

Positioning & Catalysts

With the FED having spoken, the remaining monetary heavy weight to chime in is President Trump and his trade partners. Just as the FED has priced in a worst-case scenario to their models, so have many investors as sentiment surveys remain tremendously negative. This week’s AAI Sentient survey

This survey’s view of positioning is further supported by intermediate term breadth readings. If you look at the %of Nasdaq stocks above tehir 50-day average, we are in a range typical of important market bottoms. The positing is widespread negative resulting in ample fuel for a rally should we receive a positive catalyst, such as a negotiated settlement for tariffs.

Positive Stock Action

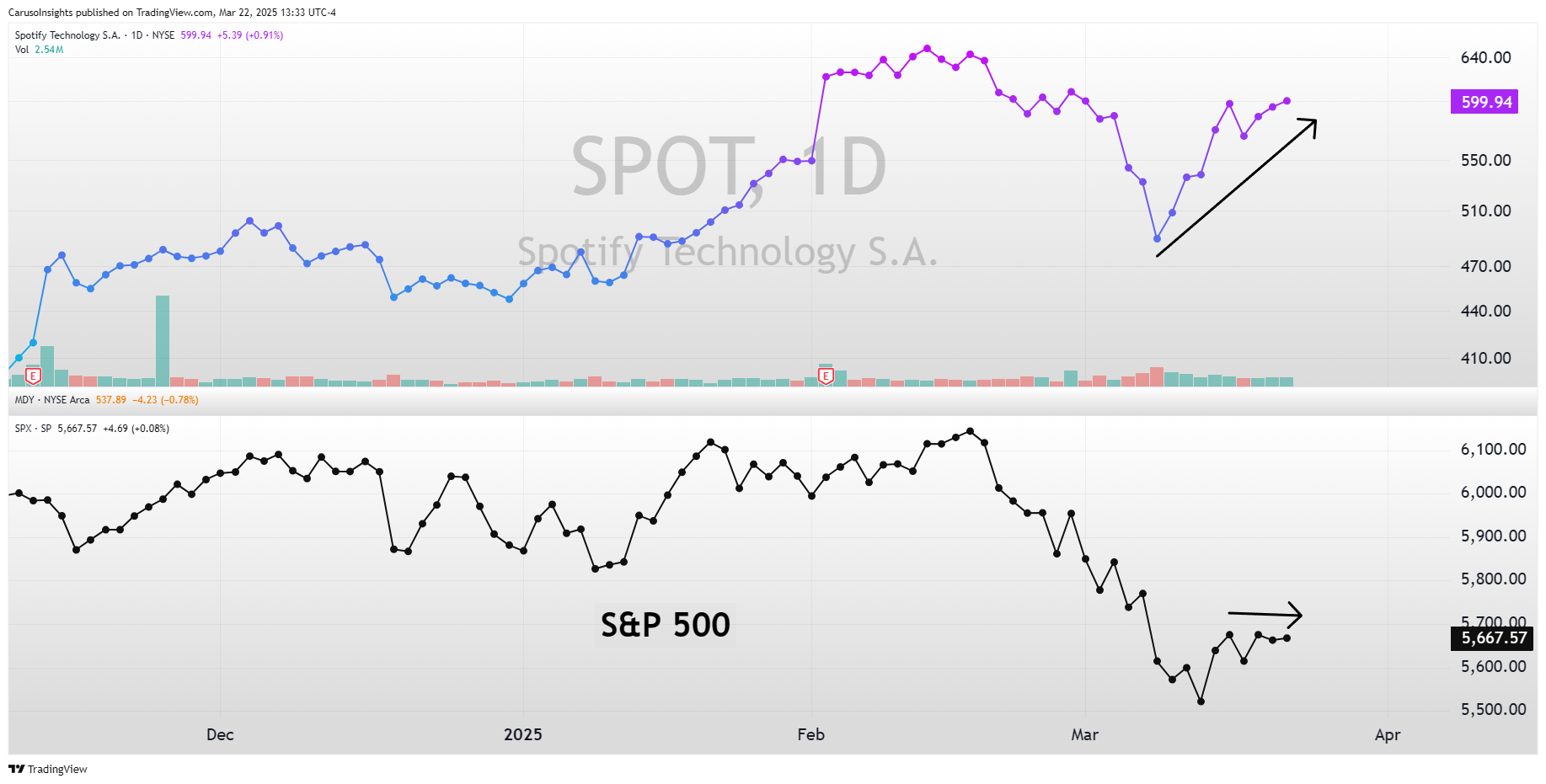

Amid the correction, the positive aspect is how standout stocks and emerging themes rise to the top. Businesses with continued growth and sticky business models such as NFLX and SPOT continue to build momentum higher against a weak general market.

Never forget the value of balancing risk management with optimism, as this quote reminds us:

Never forget the value of balancing risk management with optimism, as this quote reminds us:

“Don’t be thrown off by the swarm of gloom and doomers. In the long run, they have seldom made anyone any money or provided any real happiness. I have also never met a successful pessimist.” – William J. O’Neil

Know More About Our Membership